After 2011, the explosive grow of China’s real estate industry halted and the

golden development period for TiO2 ended. In spite of this, TiO2 capacity still

expanded uncontrollably. The consequences of severe low-end product overcapacity

were exposed in the second half of 2015 (H2 2015). A major imbalance between

supply and demand caused a collapse of the TiO2 price in China’s market.

Fluctuations in the market price of TiO2 in China in 2015

- H1 2015:

After market adjustment during Chinese Lunar New Year, the declining trend that

was initiated at the end of 2014 finally abated and the market price remained

stable before increasing during March and May, stimulated by Shandong

Doguide Group Co., Ltd. and Shandong Dawn Group Co., Ltd, and rising from

USD1,830.97/t (RMB12,000/t) to USD1,907.26/t (RMB12,500/t).

- H2 2015:

As a consequence of the long-term imbalance between supply and demand, the

market price collapsed entering the second half of the year and even the traditional

peak sales season (Sept. & Oct.) could not save the market, with the price

continuing to fall.

In Dec., the transaction price of the major sulfate

grade rutile TiO2 product dropped to below USD1,449.52/t (RMB9,500/t), almost

equal to mainstream producers’ production costs. The rate of decrease reached

24% compared to that in H1 and plummeted by over 50% compared to the peak of

USD3,051.62/t (RMB20,000/t) in 2011.

The collapse in price has directly led to the successive suspension of

production by many small-and-medium-sized enterprises, such as Jiangxi Tikou

Titanium Co., Ltd. and Luohe Xingmao Titanium Industry Co., Ltd. (Luohe

Xingmao). Even large scale enterprises, like Henan Billions Chemicals Co., Ltd.

(Henan Billions) and Shandong Doguide Group Co., Ltd. (Shandong

Doguide), reduced their operating rates slightly at the end of the year.

As a result, China’s total TiO2 output in 2015 (2.32 million tonnes) fell for

the first time in 17 years, the last time being 1998, with a YoY decrease of

4.6% compared to some 2.44 million tonnes in 2014, according to the TiO2

Sub-center of the Chemical Industry Productivity Promotion Center of China.

Of the total output of TiO2, 1.72 million tonnes was rutile TiO2, decreasing by

2.4% year on year and accounting for 73.8% of the total; 417,000 tonnes was

anatase TiO2, accounting for 18% of the total; 128,000 tonnes was non-pigment

grade TiO2, accounting for 5.5% of the total and 629,000 tonnes was denitrating

TiO2 or nano TiO2, accounting for 2.7% of the total.

From the perspective of market price and output, China’s TiO2 industry has

bottomed out in 2015. Despite this, CCM believes that this was just a period of

industry structure adjustment that had to be faced after going through a period

of high overcapacity.

From another point of view, compared to the deathly stillness and lack of

movement and innovation in the past two years, the hopeless market conditions of

2015 have, in fact, become a great catalyst for reform in the industry. A

market price that was almost equal to production cost was just like a sudden

clap of thunder, waking up speculators who were expanding capacity regardless

of what it took during the peak period.

With obsolete capacity being forced out of the market, CCM believes that a

highly dispersed industry will enter a period of consolidation and the

structure of capacity will tend to balance out, which will help China’s TiO2

industry to return to the right track within 3-5 years.

On the other hand, what is comforting is that good performance was still

achieved during a period of industry restructuring and under such depressed

conditions.

1. Domestically produced chloride grade TiO2 began to gain international recognition

In Nov.-Dec. 2015, Henan Billions vigorously marketed its chloride grade

TiO2 at the ChinaCoat Exhibition. Its long-term partner, international coating

magnate PPG Industries, Inc., announced on its official website that they had

begun to use chloride grade TiO2 produced by Henan Billions to produce coatings

and thought highly of the product quality.

On 12-14 Nov., 2015, at the annual meeting of TiO2 producers, CCM learnt from

Li Mao’en, the president of Luohe Xingmao, which is the only privately operated

chloride grade TiO2 company in China, that their chloride grade TiO2 products

had been selling abroad widely and even their TiO2 exclusively for use on plastics

had gained a good reputation.

On 30 Dec., 2015, Pangang Group Vanadium Titanium &

Resources Co., Ltd. released an announcement, revealing that they planned to

invest USD16.78 million (RMB110 million) to build a chloride TiO2 project and

to become the fifth Chinese company to enter the field.

2. First international level Chinese TiO2 giant to be born

On 5 May, 2015, Henan Billions announced that it was acquiring Chinese leading

TiO2 company, Sichuan Lomon Titanium Co., Ltd. (Sichuan Lomon). Currently, the

TiO2 capacity of Sichuan Lomon reaches 300,000 t/a and that of Henan Billions stands

at 220,000 t/a, ranking No.1 and No.2 respectively in China.

After the marriage

between the two, a total capacity as high as 520,000 t/a will make it the

fourth largest TiO2 company in the world. At that time, the international

competitiveness and global market share of China’s TiO2 industry will be

improved significantly.

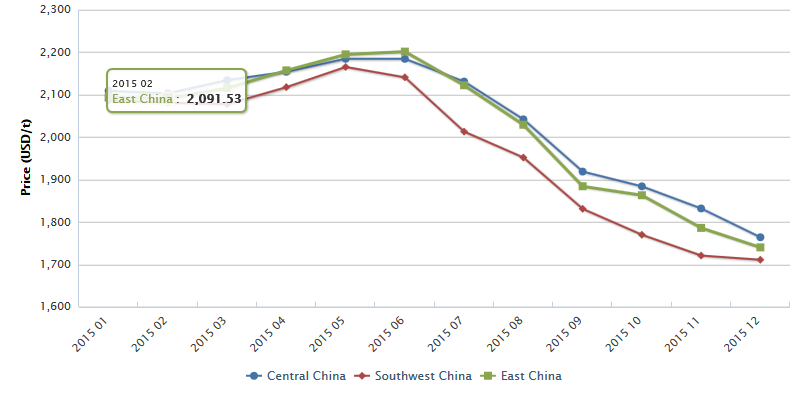

Ex-works price of rutile TiO2 in China by region, mid-Jan. 2015 to mid-Dec.

2015

Source: CCM

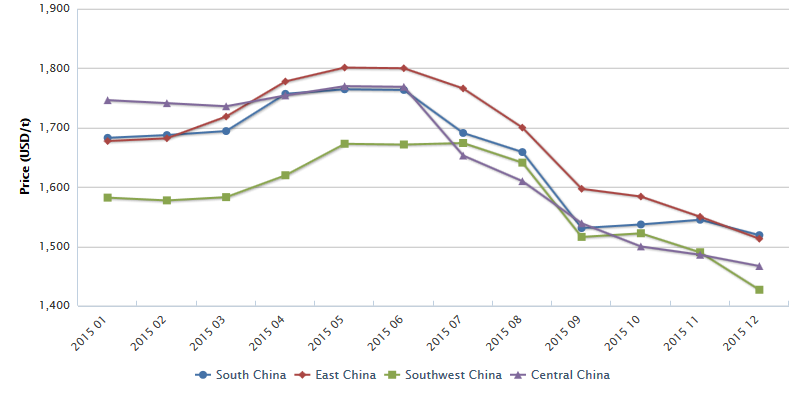

Ex-works price of anatase TiO2 in China by region, mid-Jan. 2015 to mid-Dec.

2015

Source: CCM

China's TiO2 output, 2010-2015

Source: TiO2 Sub-center, Chemical Industry Productivity Promotion Center of

China

This article comes from Titanium Dioxide China Monthly Report 1602, CCM

About CCM:

CCM is the leading market intelligence provider for China’s

agriculture, chemicals, food & ingredients and life science markets.

Founded in 2001, CCM offers a range of data and content solutions, from price

and trade data to industry newsletters and customized market research reports.

Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a

brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.

Tag: TiO2 chloride